Federal Tax Fraud Attorney in New York City

Top Rated Lawyer in White-Collar Criminal Defense

-American Lawyer Media and Martindale-HubbellTM

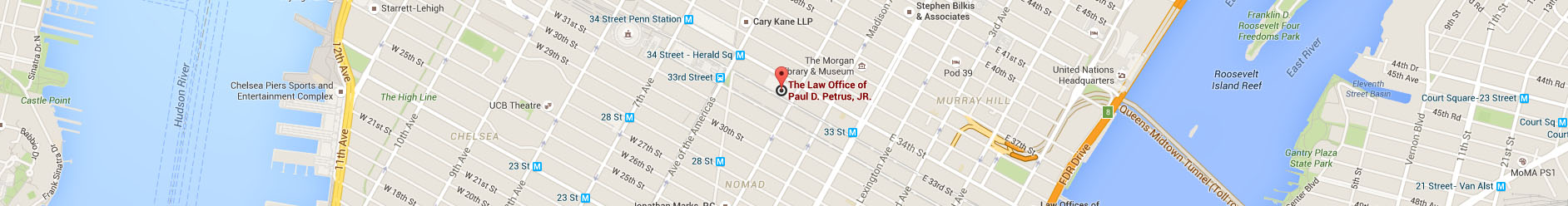

If you or your company has been accused of failing to comply with Tax Laws, the consequences could be severe — including large fines and imprisonment. Therefore, it is essential to work with a well-qualified NYC federal criminal defense lawyer who can help you obtain the best possible results. At the Paul D. Petrus Jr. & Associates, P.C., we prepare strong and effective defenses against tax fraud allegations.

Sections § 7201-7216 of the Internal Revenue Code contains 15 different criminal statutes concerning various evasions, omissions, and false statements regarding filing of returns and payment of income taxes. The decision to prosecute a criminal tax case is the culmination of a lengthy and complex administrative process involving both the Internal Revenue Service and the Department of Justice.

If you are facing charges related to tax fraud, contact the Manhattan criminal defense lawyers at Paul D. Petrus Jr. & Associates, P.C.