Theft Crimes in NYC

Theft crimes contain more specific crimes such as burglary, petty theft, embezzlement, fraud, robbery, identity theft and many others. These crimes all have one thing in common: a person that has knowingly, unlawfully stolen another person’s property without their consent. Theft crimes can be violent and non-violent, with non-violent offenses usually receiving less severe sentences. Those who threaten with physical harm, or actually commit physical violence are expected to be sentenced to a much harsher punishment.

The value of items stolen is an important factor in penalties for theft crime convictions. The total value of items stolen will help determine whether the crime is a misdemeanor or a felony. Felonies can lead to a significantly longer prison sentence, very costly fines and compensation in cases where a civil lawsuit has been filed. Even lesser theft crimes, such as petty theft, require an effective lawyer. New York State does not have expungements for any of these crimes, and they will remain on your record, if you are convicted.

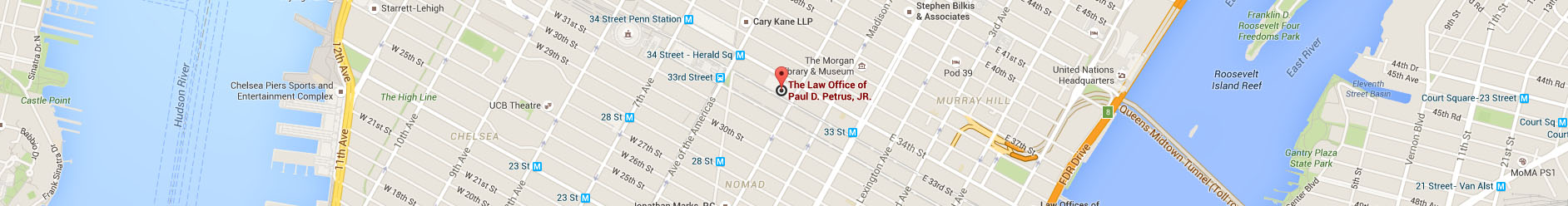

If you have been charged with a theft crime, you should immediately speak with a criminal lawyer NYC. Going through the legal process with a qualified professional to guide you and protect your rights will be a great advantage. Paul D. Petrus Jr. has extensive knowledge of the different charges that are relevant to theft crimes. You need an attorney who understands that your case may be complicated, atypical and in need of personalized representation.

Call for a free consultation.

212.564.2440

ATM skimming

ATM skimming is a crime which is happening in New York City and other cities across the nation. ATM Skimming is a method by which a thief places an electronic device on an ATM which copies your bank account details from the magnetic strip on your credit or debit card when you use the ATM. The problem is that the devices planted on ATMs are usually undetectable by users. Also, a hidden camera is installed on or near the ATM, to take a picture as each customer enters their PIN number into the ATM’s keypad.

When Customers insert their ATM card into the phony reader, their account info is swiped and stored on a small attached laptop or cell phone or is sometimes sent wirelessly to the criminals waiting nearby.

After copying the details, the criminal then create a fake or ‘cloned’ card. In most cases, they use the fake card and PIN to withdraw money from an ATM. Card skimming can also happen when you use EFTPOS. These skimming devices are installed for a few hours. After swiping the information from the card, the devices are removed.

If you suspect that you have been a victim of ATM Skimming, call Paul D. Petrus (212-564-2440) right away!